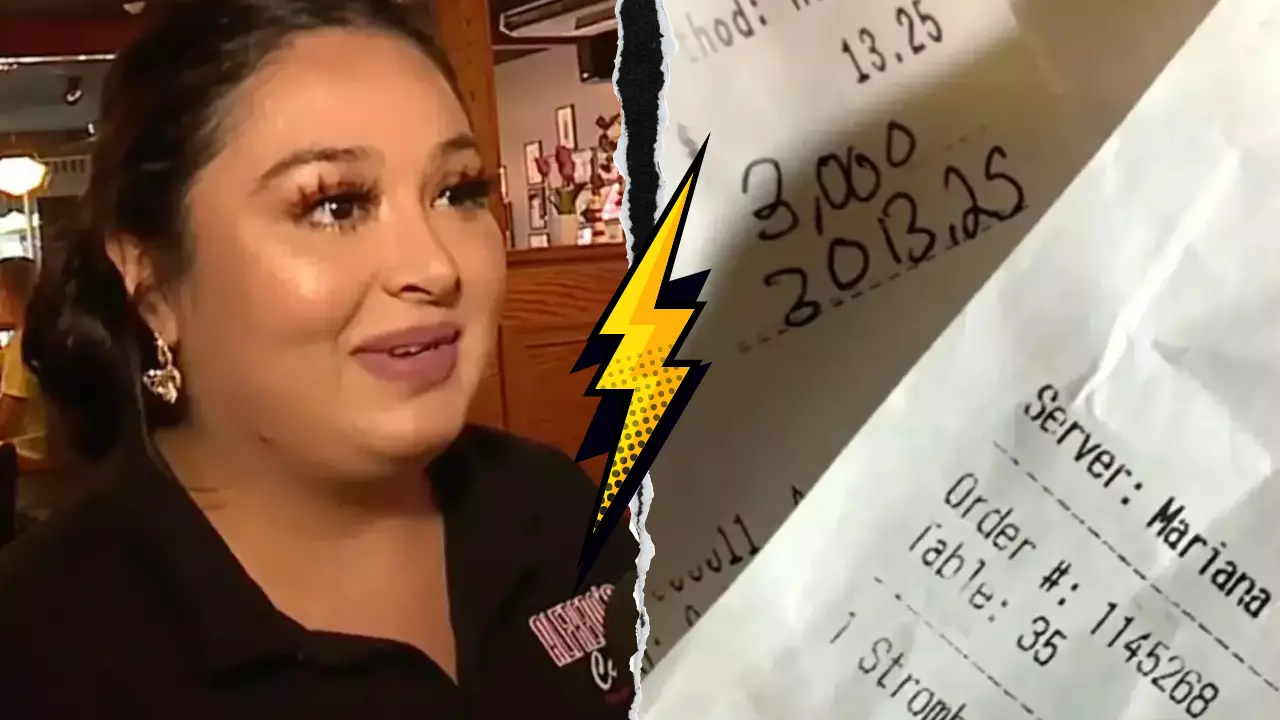

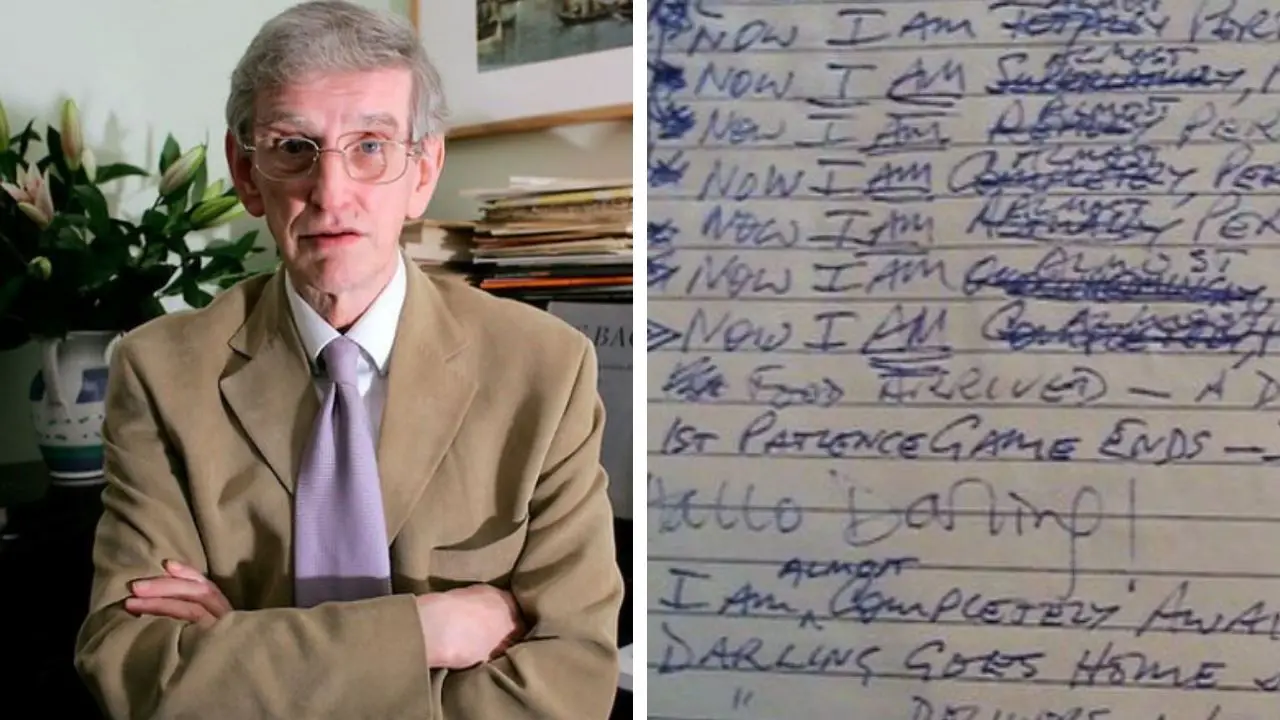

Woman says she was charged 17 times after a single Costco visit, totaling over $5,200

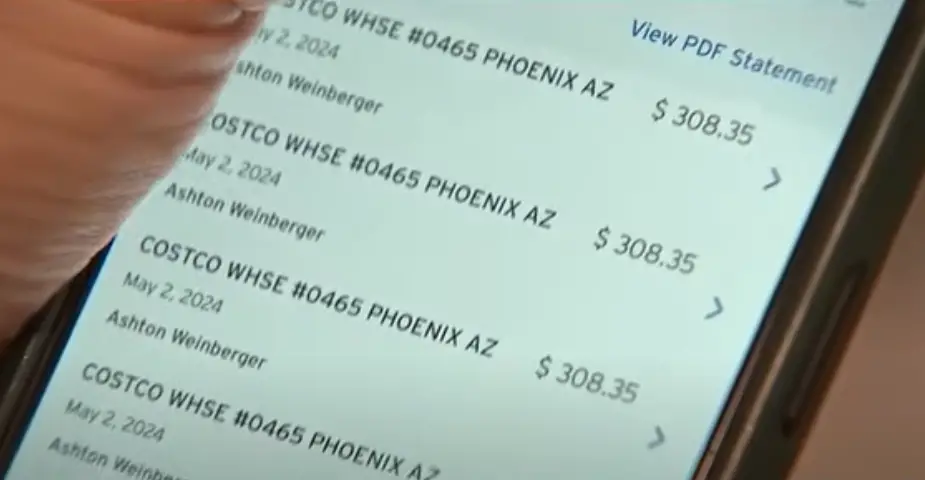

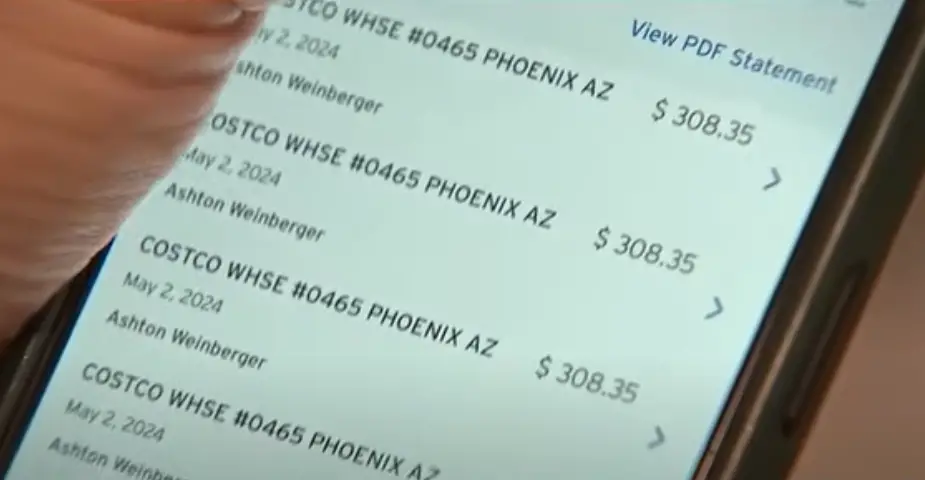

A Phoenix woman, Ashton Weinberger, was shocked to discover that her $308 purchase at Costco was charged to her credit card 17 times, totaling over $5,200.

The incident, which occurred in April 2024, left her in a financial bind amid ongoing home renovations.

The Incident

Ashton Weinberger, a resident of Phoenix, Arizona, visited her local Costco near Arcadia in April 2024 for a routine shopping trip.

She purchased items totaling $308.35 and paid using her Citi credit card.

However, shortly after the purchase, she began receiving text alerts from her credit card company indicating that the same charge was being posted multiple times.

“I start getting texts from my Citi card text alert, that that same charge had hit again,” Weinberger told.

“Now at first, I was thinking, ‘Oh, that’s weird. It’s delayed.’ But then it hit again and again and again.”

Ultimately, the $308.35 charge was posted 17 times, resulting in a total of $5,241.95 on her credit card statement.

Impact on Weinberger

The timing of this error couldn’t have been worse for Weinberger. She and her husband are currently undertaking an extensive renovation of their Phoenix home, which has already stretched their budget thin.

“With our living and kitchen areas torn up and work underway, this is an added financial strain,” Weinberger explained.

“When you’re doing renovation, you are very tightly budgeting.

You need all the finances that you have available, so to suddenly not have $5,000 – it’s critical to getting the project done. So, it’s very stressful.”

The unexpected charges disrupted their financial planning. The couple relied on every dollar to complete their home project.

Losing access to over $5,000 created significant stress and uncertainty.

Attempts to Resolve the Issue

Weinberger immediately contacted Costco to report the error. However, she claims the store was unhelpful.

“So, I’m back to Costco. They had no idea,” she said.

“I showed them all the charges. And they said, ‘Well, we’ll look into it,’ and then days went by. [I’ve been] calling the credit card, calling Costco, going back to Costco or calling the credit card, no one has any information.”

Frustrated by the lack of resolution, Weinberger reached out to AZ Family, a local news station, for assistance. The station then contacted Costco on her behalf.

Costco’s Response and Resolution

Following the involvement of AZ Family, Costco began to address the issue. However, as of May 30, 2024, the duplicate charges were still present on Weinberger’s account.

In a follow-up report on July 17, 2024, AZ Family announced that the situation had finally been resolved, with Costco removing the excess charges from Weinberger’s account.

Costco extended an olive branch to alleviate Weinberger’s concerns, though specific details of their actions were not disclosed.

Why Do Duplicate Charges Happen?

Duplicate charges on credit cards can occur for several reasons.

One common cause is authorization holds, where merchants place a hold on the card for the purchase amount, which can appear as a separate charge before the actual transaction is processed. (Wise Help)

Technical errors in the payment processing system can also lead to duplicate charges.

Additionally, merchant errors, such as accidentally processing a payment more than once, or errors on the part of the credit card issuer can result in multiple charges for the same transaction. (Pocketsense)

In Weinberger’s case, since it was an in-store purchase at Costco, it’s likely that there was a glitch in their point-of-sale system that caused the charge to be posted multiple times.

Such errors are rare but can have significant consequences for consumers.

What to Do If You’re Double-Charged

If you find yourself in a situation where you’ve been double-charged, here are some steps you can take:

Contact the Merchant: Immediately reach out to the store’s customer service. For Costco, you can visit the returns counter with your receipt Costco Customer Service.

Check Your Bank Statement: Verify the charges and keep records of all communications.

Dispute with Your Credit Card Company: If the merchant doesn’t resolve the issue, you can dispute the charge with your credit card issuer, especially if it’s within the 60-day window provided by the Fair Credit Billing Act.

Seek Media Assistance: If all else fails, contacting local news or consumer protection agencies can sometimes help, as seen in Weinberger’s case.

| Step | Action | Details |

|---|---|---|

| Contact Merchant | Visit or call the store | Bring receipt to Costco’s returns counter |

| Check Statement | Verify charges | Keep records of all transactions and communications |

| Dispute Charge | Contact card issuer | File within 60 days under Fair Credit Billing Act |

| Seek Media Help | Reach out to news outlets | Local stations or consumer agencies may assist |

Costco’s Policy on Billing Errors

According to Costco’s customer service page, if you were charged the wrong amount at the warehouse, you should head to the returns counter with your receipt, and a member of the Costco team will assist you Costco Customer Service.

For online orders, Costco explains that your credit card will be charged only after your item ships, and if there are multiple items, you might see separate charges as each item ships.

Additionally, there might be pre-authorization holds that can appear as pending charges but are not actual charges Costco Online Orders.

Are Duplicate Charges Common at Costco?

While duplicate charges can occur at any retailer, they are relatively rare, especially to the extent experienced by Weinberger.

At Costco, most instances of double charging reported by customers involve one or two items, often due to scanning errors or processing mistakes.

For example, customers on forums like Reddit have reported being charged twice for a single item and needing to visit customer service for a refund.

However, being charged 17 times for a single purchase is exceptionally rare and suggests a more significant issue, possibly a glitch in the point-of-sale system or a misconfiguration in the payment processing.

Such cases are not typical and indicate a need for retailers to review their systems to prevent similar errors.

| Incident Type | Frequency | Cause | Resolution |

|---|---|---|---|

| Single Duplicate Charge | Occasional | Scanning error | Refund at returns counter |

| Multiple Duplicate Charges | Rare | System glitch | Requires escalation, media help |

While such drastic billing errors are infrequent, they underscore the importance of promptly addressing any discrepancies.

Weinberger’s experience, though resolved after significant effort and media intervention, highlights the need for retailers to have robust systems in place to prevent and quickly correct such errors.

For consumers, knowing the steps to take when faced with billing irregularities can save time, money, and stress.

Regularly checking credit card statements and acting swiftly can prevent minor errors from becoming major financial burdens.