2025 Scam Alert: Unmasking the Latest Scam Tactics

Scams are evolving at an alarming pace. Criminals are leveraging cutting-edge technology, like artificial intelligence (AI), to make their schemes more convincing and harder to detect.

In 2025, staying safe means understanding the latest twists on old tricks and the new threats emerging.

According to the Global Anti-Scam Alliance (GASA), over $1.03 trillion was lost to scams worldwide in 2024—a clear sign of how widespread and damaging these crimes have become.

This report outlines the most dangerous scams you need to watch out for, offering practical tips to protect yourself and your loved ones.

1. AI Scams: The Future of Fraud

AI is transforming scams, making them more realistic and harder to spot.

Scammers use generative AI tools to create convincing text, images, and videos, scaling their operations to target thousands at once.

Phishing and Smishing: AI crafts emails and texts that mimic legitimate companies, tricking you into sharing sensitive information or clicking malicious links.

AI Images: Scammers generate fake profiles, ads, or even identification documents to build trust.

Deepfake Videos: These promote fake products or impersonate trusted figures, like celebrities or family members.

Fake Voices: AI-cloned voices sound like someone you know, often used in phone scams to create urgency.

The FBI issued a warning in December 2024 about AI-driven scams (FBI PSA). GASA reported a 1,500% surge in deepfake-related crimes in the Asia-Pacific region from 2022 to 2023, highlighting the global threat.

For example, scammers might use a deepfake video of a celebrity endorsing a fake investment, making it seem legitimate.

Red Flag: If a message, call, or video feels slightly off, verify the source independently before acting.

2. Imposter Scams: Pretending to Be Someone You Trust

Imposter scams remain a top threat, with scammers posing as friends, relatives, celebrities, or government officials.

These scams are broad, covering everything from grandparent scams to fake company alerts.

Contact Methods: The Federal Trade Commission (FTC) notes that phone calls as the first contact dropped from 67% in 2020 to 32% in 2023. Email and text messages are now preferred, as they’re harder to trace.

Losses: In 2023, 20% of imposter scam victims lost money, with a median loss of $800. Government imposter scams saw median losses of $14,740 in early 2024.

Multi-Party Scams: A fake company text might direct you to an accomplice posing as a bank employee or government agent.

Spotlight: Scammers often create urgency, claiming you owe money or face legal action. Always verify the source using a trusted contact method.

| Imposter Scam Type | Median Loss (2023) | Primary Contact Method |

|---|---|---|

| General Imposter | $800 | Email/Text (32% phone) |

| Government Imposter | $14,740 (Q1 2024) | Email/Text |

3. Sextortion Scams: Targeting Kids and Teens

Sextortion scams are a growing concern, particularly for children and teens.

Scammers pose as peers or romantic interests to trick victims into sharing explicit photos or videos, then demand ransom to keep them private.

How It Works: Scammers may send stolen or AI-generated explicit images to build trust, then threaten to share the victim’s material with friends or family.

Speed: These scams often unfold in under an hour, leaving victims too embarrassed to seek help.

The FBI (Sextortion Resources) and the National Center for Missing and Exploited Children’s CyberTipline (CyberTipline) offer support, including help removing explicit content online.

Tip for Parents: Discuss online safety with your kids and encourage them to report suspicious interactions immediately.

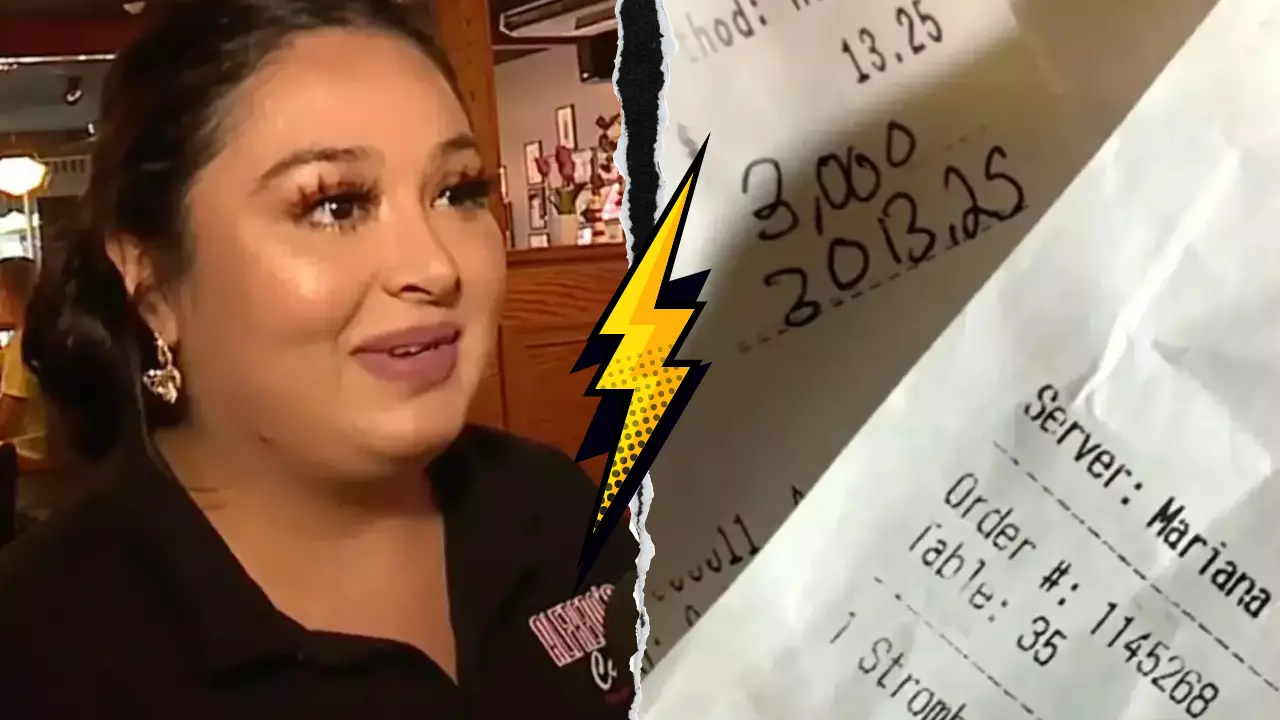

4. Romance Scams: Love Turned Lethal

Romance scams exploit trust, with scammers creating fake profiles on dating apps or social media.

AI has made these scams more convincing, using deepfake video calls or cloned voices to seem real.

Tactics: After building trust, scammers ask for money, gifts, or “investment tips” that lead to further scams. Some send “accidental” payments, asking you to return or forward the funds, which are later flagged as fraudulent.

“Accidental” Texts: A new tactic involves texts that seem meant for someone else, like “Sorry I’m late.” Responding can draw you into a romance or employment scam.

The Better Business Bureau (BBB Risk Report) reported a median loss of $3,800 for romance and investment scams in 2023, with over 80% of victims losing money.

Warning: If someone you’ve never met asks for money or personal details, it’s likely a scam.

5. Phone-Related Scams: Your Smartphone Is the Target

Smartphones are a prime target for scammers, offering access to your data and accounts. Here are the top phone-related scams in 2025:

Robocalls: Automated calls with AI-generated voices offer deals or threaten legal action (Robocall Info).

Malicious Apps: Fake apps steal data or install malware.

QR Codes: Fake QR codes in public spaces lead to phishing sites or prompt unwanted purchases.

SIM Swapping: Thieves reassign your phone number to intercept authentication codes (SIM Swapping Protection).

OTP Bots: Bots mimic companies to trick you into sharing one-time passwords.

NatWest Group noted a rise in fake parcel delivery texts in 2024, a trend continuing into 2025 (NatWest Scams).

Protection Tip: Avoid unknown links and use authenticator apps instead of SMS for two-factor authentication.

6. Cryptocurrency and Investment Scams: Riding the Crypto Wave

Cryptocurrency prices surged after the 2024 presidential election, fueling a wave of scams. These often involve fake prizes, contests, or “exclusive” investment opportunities.

How They Work: Scammers impersonate celebrities or create fake websites to lure victims. OTP bots can lock you out of crypto accounts while funds are drained.

Losses: The BBB ranked these as the riskiest scams in 2023, with a median loss of $3,800 and over 80% of victims reporting losses.

AARP reported that cryptocurrency scams cost Americans aged 50-59 $900 million in 2023 (AARP Crypto Scams).

Beware: Research investments thoroughly and avoid sending money to unverified sources.

7. Online Purchase Scams: The Fake Storefront Boom

Online shopping is convenient but risky, with fake e-commerce sites and social media ads proliferating.

Tactics: Scammers set up lookalike stores or list items on marketplaces that never arrive. “Triangulation fraud” involves buying items with stolen credit cards and selling them to you.

Refund Phishing: Scammers trick victims into providing personal info while disputing fake charges.

The BBB reported that online purchase scams accounted for over 40% of all scams in 2023, with a median loss of $100 (Online Shopping Red Flags).

Tip: Use credit cards for purchases and check for red flags like unrealistically low prices.

| Scam Type | Median Loss (2023) | % of BBB Reports |

|---|---|---|

| Online Purchase | $100 | >40% |

| Crypto/Investment | $3,800 | High Risk |

8. Employment Scams: The Job Offer Trap

Job seekers are prime targets, especially with economic uncertainty. Scammers offer fake jobs or “easy income” opportunities.

Task Scams: You’re hired for simple online tasks but must pay to “unlock” earnings. FTC reports jumped from 5,000 in 2023 to 20,000 in the first half of 2024 (Job Scam Info).

Money Mule Jobs: You’re asked to transfer money or reship packages, often for illegal activities.

Warning: Legitimate jobs don’t require upfront payments or suspicious transactions.

9. Check Fraud: A Low-Tech Crime with High Impact

Check fraud remains a problem, with criminals stealing checks from mailboxes or during transit to create counterfeits.

Impact: Victims may face temporary loss of funds while banks investigate.

Prevention: Use secure mailing methods or switch to electronic payments (Check Fraud Info).

10. Emerging Scams to Watch

Beyond the major categories, new scams are gaining traction in 2025:

Parking Fine Scams: Fake notifications about unpaid fines link to phishing sites (Rest Less Scams).

Booking.com Scams: Scammers steal account details and send phishing emails for payments.

Charitable Donation Scams: Fake fundraisers exploit crises, with around 200 reports to Action Fraud (Action Fraud).

How to Avoid a Scam

Scammers are clever, but you can outsmart them with these strategies:

Be Skeptical: Question unsolicited contacts, especially those requesting money or personal info.

Don’t Click Unknown Links: Avoid links in emails, texts, or messages unless you’re certain they’re safe.

Update Devices: Keep software current to protect against malware.

Enable Multifactor Authentication: Use non-SMS methods like authenticator apps.

Research Companies: Check reviews on sites like Charity Navigator or the BBB.

Watch for Suspicious Payments: Scammers often demand gift cards, wire transfers, or cryptocurrency.

Create a Family Password: Use a secret word to verify identities in case of imposter scams.

What to Do If You Fall Victim

If you’ve been scammed, act fast:

Report It: File a report with the FTC, BBB, and local police.

Contact Your Bank: Report fraudulent transactions immediately.

Change Passwords: Update passwords on compromised accounts.

Scan for Malware: Run antivirus scans on your devices.

Protect Your Credit: Consider a credit freeze to prevent identity theft (Experian Credit Monitoring).

Scams in 2025 are more sophisticated, driven by AI and other technologies. From deepfake videos to fake job offers, criminals are finding new ways to exploit trust.

But knowledge is power. By staying informed and following basic safety measures, you can protect yourself and your family.

If something seems too good to be true, it probably is. Verify before you act, and stay vigilant.