ESG & SRI: Sustainable Responsible Impact investing

Things to consider before investing in a company

To achieve a long-term investment performance, a responsible investing approach must be followed. Before investing in a firm, it is necessary to do two key analyses based on financial criteria and ESG principles.

- Financial Criteria: Profitability, Business models, Sector, competitiveness

- ESG principles: Environmental, Social, Governance

Types of sustainable investing

- ESG: Environmental, Social and Governance investing

- SRI: Socially Responsible Investment

- Impact investing

What is ESG investing?

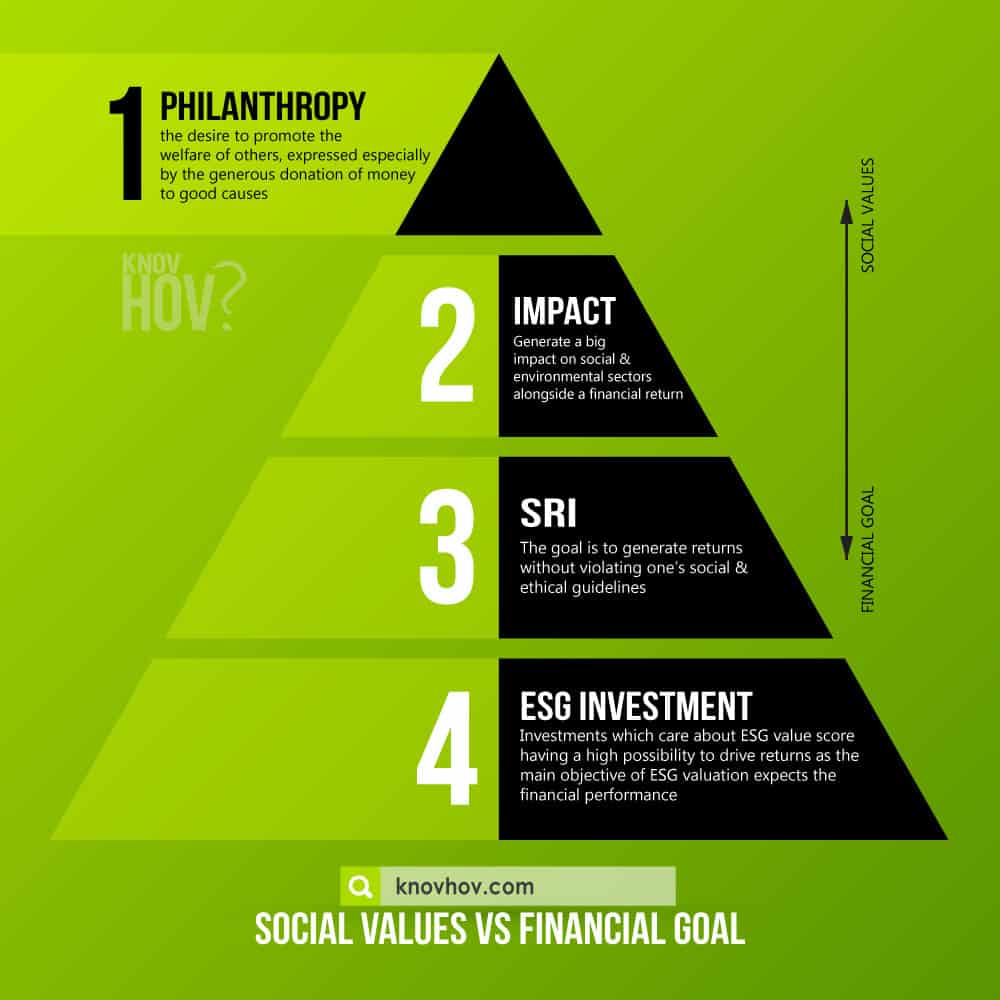

ESG: Environmental, Social and Governance investing. It is one of the finest long-term investing strategies, focusing on investments that aim to provide beneficial returns for society, the environment, and corporate governance. ESG-focused investments have a high chance of driving profits. It is the primary goal of ESG valuation, which is based on financial success.

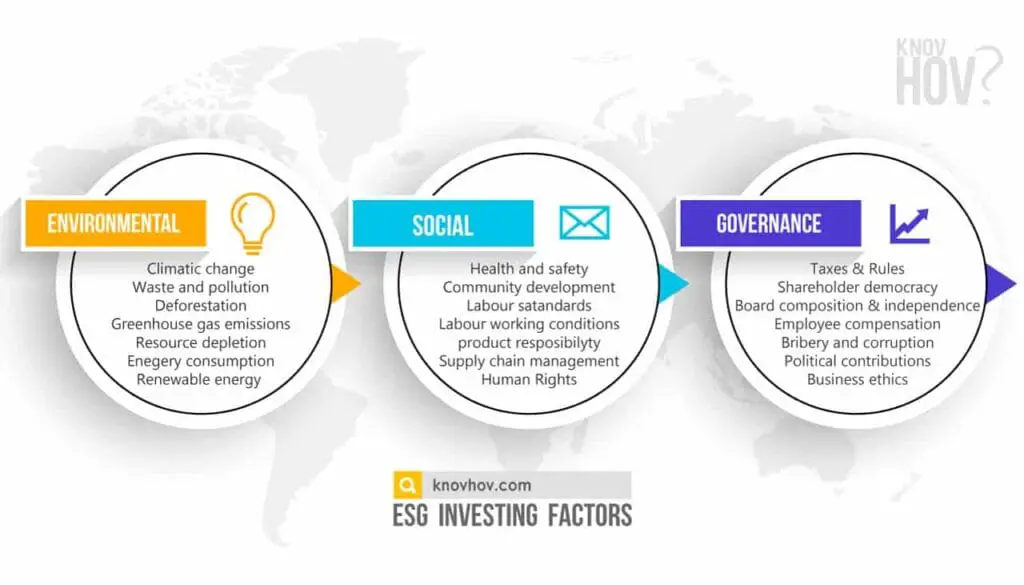

ESG factors list in investing explained

ESG factors are essential in determining if a company is likely to encounter hazards in the future and in learning about the factors that might impact a company’s financial performance. Following the ESG criteria and maintaining good sustainable investment management can lead to a company’s long-term success.

7 Environmental factors to consider in ESG investing

- Climatic change

- Waste and pollution

- Deforestation

- Greenhouse gas emissions

- Resource depletion

- Energy consumption

- Renewable energy

7 Social factors to consider in ESG investing

- Health and safety

- Community development

- Labor standards

- Labour working conditions

- Human rights

- Customer and product responsibility

- Supply chain management

7 Governance factors to consider in ESG investing

- Taxes & Rules

- Board composition & independence

- Business ethics

- Shareholder democracy

- Employee compensation

- Bribery and corruption

- Political contributions

What is SRI: Sustainable Responsible Impact investing?

SRI investing, also known as Socially Responsible Investment, is a type of investment that attempts to provide both social and financial benefits to investors. Sustainable and responsible investment processes provide significant social effects while excluding those that are detrimental to the investment.

Profit is critical in ESG and SRI investing, but profits must be weighed against principles. The objective is to make money while staying within one’s social and ethical norms.

Factors that have a negative impact on SRI investment: Sustainable Responsible Impact investing

- Human rights violations

- Violation of weapons and defense policy

- Gambling, Alcohol & Tobacco addiction

- Labor violations

- Environmental pollution

What is impact investing

Sustainable impact investing is a method for investing in firms and enterprises that aims to have a positive influence on the social and environmental sectors while still generating a profit. As a result, the primary purpose is to assist a company or organization in achieving certain goals that are both good for society and the environment.

Factors affecting the impact of an investment

- The ultimate outcome must be derived from the investment’s operations and goods.

- There must be an influence on people’s lives as they evolve.

- The impact must be connected to a community’s benefit.

- The solution’s consequences must be attainable and exploitable.

- The final outcomes must be achieved within the investment’s time range.

What is philanthropy investment?

Philanthropy is defined as investing and supporting the welfare of the community’s helpless people, particularly via the generous giving of money and responsible investing of finances to good projects with social and environmental effects.

Benefits of ESG investing & integrating ESG factors in a company

- Integrating ESG management aspects is a critical component of a company’s long-term success.

- ESG responsible investing can assist to mitigate an investment’s risks.

- ESG in finance aids in the early detection of hazards and the better management of such risks.

- Long-term investment possibilities can be identified through ESG sustainable research.

- Give meaning to investing by adding value to ESG’s ethical and social client portfolios.

Looking to maximize your financial potential? Tax accountant Penrith offers specialized expertise in tax and business services to help streamline your finances and fuel your business growth.

With a commitment to exceptional service, we ensure that your tax planning and financial strategies are tailored to meet your unique needs, setting you up for success in every aspect of your financial journey.